The Beauty Brand Launch Campaign: A How-To

A Model for a Modern Fragrance Launch, Sans Célébrité

The context

Beauty brand launch campaigns have done it all: inspired, they’ve provoked, even demeaned and put Giselle Bündchen on a surfboard.

In this era of rampant retail disintermediation and DTC, the beauty brand launch environment has never been more saturated.

In the past 5 years, the number of beauty brand launches has skyrocketed. So, too, have budgets for launch, thanks to a burst of beauty-focused private equity and venture capital funding. And then there are the celebrities. As Allure Magazine put it in 2021: “If it’s a day of the week ending in Y, a celebrity is probably launching a skin-care or makeup line.”

This page analyses our strategy for the game-changing global fragrance launch for Guerlain’s Le Petite Robe Noir. This case study is put in context of both standard beauty brand launch convention/formula, as well as the changes happening in the beauty market as we look to 2023. This page gives key insights for anyone planning beauty brand marketing at a time when brands can no longer afford to follow formula.

So what, exactly, is the beauty brand launch campaign formula?

The Formula

Beauty brand launch campaigns tend to follow a 3-part formula:

1. Face

Beauty and fragrance consumer marketing campaigns overwhelmingly have a “face” – a celebrity or model demonstrating the product’s promised outcome, and semiotically, the product’s intended audience. The inherent challenge is that, like beauty or fame itself, brand equity can fade when it’s tied to celebrity endorsement deals that can, over time, run their course.

2. “Factice”

Factice refers to the giant bottles of perfume seen at department and duty free stores. Historically, the classic beauty brand launch begins with shelf space at standard-bearer retailers or “beauty counters.” If a beauty brand is new, the illusion of “exclusive” distribution at a single retailer can suffice until the brand is proven, or to maintain exclusivity.

In a new era of beauty brand launch campaign strategy, the concept of “factice” might be swapped – to maintain alliteration – with the customer “Funnel”. Essentially: how will the brand connect with customers to drive sales? Even in the early-DTC era of Cher and Christy Brinkley selling beauty products on Home Shopping Network and QVC, “Funnel” involved the viewing audience and those station’s backend capabilities for distribution and fulfilling sales. This is a piece of beauty launch that is changing rapidly in light of advancements of performance media making retailers an additive – but no longer essential – part of the beauty space.

3. Frequency

Finally, frequency is the final and arguably most important step. Frequency generally refers to the number of times an individual sees an ad. For beauty, frequency is everything. It takes repetition to make the point that a product is a necessity. Worth the investment. The epitome of cool. A brand that “gets you.” And that a specific brand’s product can make you as desirable as the Face it’s associated with. In sum: Frequency is the pivotal part of the beauty brand launch campaign that establishes the brand as desirable and drives urgency to purchase.

Case Study: Context

When a 180 year-old French fragrance house approached us with a new fragrance, they came prepared to re-write the beauty brand launch formula.

Our client was set on launching a new, global product aimed at a younger consumer. And importantly, they sought to omit a classic advertising centerpiece: the “hook” of the celebrity endorsement.

This decision influenced the campaign’s creative look and feel. It demanded a novel approach to paid media strategy and frequency, given the global nature of the product and aggressive sales goals. Key details of this highly-confidential brand launch campaign:

- Face: Campaign creative was developed by the client in-house, intentionally sans célébrité.

- Factice: Global consumer-facing launch at all key fragrance points of sale, with special emphasis on airport retail and in-flight, duty free, which carry measurement challenges.

- Frequency: Media strategy was marked by a desire to use nontraditional media.

Celeb Beauty Brand Boom

As mentioned before, our launch came at the dawn of a boom in beauty brands backed by celebrities. While celebrity beauty brands aren’t necessarily new, there are four key reasons why we’re seeing so many new beauty brand launches:

- Firstly, beauty, as a category (including, and especially, fragrance) has fabulously high product margins. It’s profitable.

- Next, beauty brands are (relatively) easy to launch. With the proliferation of white-label factory operations and drop shipping, beauty products are easy to create and produce.

- Third, social media creates the illusion of easy access to mass exposure. Whether you’re a celebrity with millions of followers or an VC-backed brand manager looking to buy exposure, social platforms promise easily-accessible reach. But whether they can deliver at a reasonable CAC is dependent on a final factor: funding.

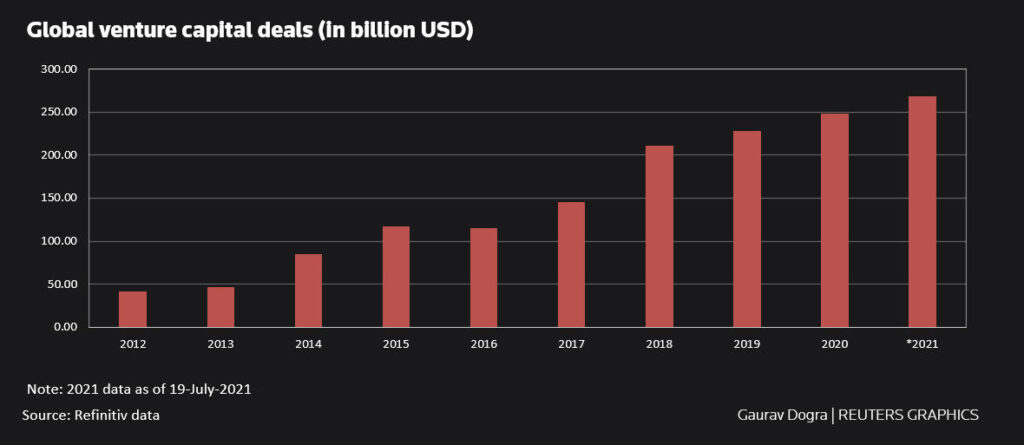

- Finally, and perhaps most importantly: global venture capital funding is on a spree, soaring to all time highs. The value of global deal flows is nearly double what they were in 2016, and 5x what they were in 2012. This means, for new beauty brand launches (and other startups), there is more money being deployed for startups than ever before.

Why does this matter to celebrity beauty brand launches, and the beauty industry at large?

By our internal estimates, the increase in celebrity-backed beauty brand launches specifically has accelerated competition for share of voice by as much as +30% over the past 5 years on certain media channels, given the size of their organic audience and formula for paid media deployment of VC funding.

Here’s a brief history in beauty brands with stars holding beauty brand equity interest:

Iman, Makeup for Women of Color, Iman.

Meaningful Beauty, Cindy Crawford. Living Proof (hair), Jennifer Aniston (acq., Unilever in 2016).

Josie Maran Cosmetics, Josie Maran.

Kora Cosmetics, Miranda Kerr.

Honest Company, Jessica Alba. (IPO in 2016)

Flower Beauty, Drew Barrymore.

MDNA, Madonna (US launch 2019).Kylie Cosmetics, Kylie + Kris Jenner, backed by Seed Beauty.

goop skincare, Gwyneth Paltrow. (goop launched 2008, skincare arrived 2016).

Fenty, Rhianna.KKW Beauty, Kim Kardashian, 2017 – 2020.

ProDNA (skin), Paris Hilton. Hilton has launched 25 fragrances.House 99 (men’s grooming), David Beckham.

Haus Laboratories, Lady Gaga. (“This is not just another beauty brand.” Per Haus.)Victoria Beckham Beauty, Victoria Beckham.Henry Rose (fragrances), Michelle Pheiffer.

Fenty Skin, Rhianna.Rare Beauty, Selena Gomez.Keys Soulcare, Alicia Keys, collab with E.L.F.Humanrace (skin), Pharrel Williams.Biossance, Reese Witherspoon: a 5-year deal rumored to involve equity.

JLo Beauty, Jennifer Lopez.nomaly (hair), Priyanka Chopra Jones.Know Beauty, Madison Beer and Vanessa Hudgens.Treslúce Beauty, Becky G.About-Face, Halsey.Proudly, Gabrielle Union-Wade and Dwayne Wade. Bardi Beauty, Cardi B (USPTO Filing April, 2021).Kris Jenner Beauty (USPTO filing, Feb 2021).“SKNN,” Kim Kardashian (USPTO filing, March 2021).

Rose, Inc., Rosie Huntington-Whiteley.R.E.M., Ariana Grande.Rhode (skin), Hailey Bieber.Brand Name TBD, Harry Styles.Brand Name TBD, Scarlett Johansson. Johansson is known for repping L’oreal Paris and Dolce & Gabbana’s “The One” Fragrance.LolaVie, Jennifer Aniston (USPTO filing 2019), rumoured launch 2022.

Never to be outdone, Kim K has now launched her own Private Equity fund with ex-Carlyle partners. Suffice to say: celebrities are no longer walk-on, walk-off spokesmodels. They want cold, hard equity.So what does this mean for ambitious brand launches (particularly those lacking a celeb face)? Read on to find out.

"How-to" + Insights

So how should smart brands execute a beauty brand launch campaign? Let’s revisit the 3-part beauty brand launch formula with a lens toward specific opportunities for disruption:

1. Face

Obviously, if you represent a celebrity beauty brand, this piece is a given. But for brands focused on a different angle, consider: who or what gives your brand voice? Differentiation is par for the course. Consider a “wish list” for casting and define what, precisely, makes your product essential to a specific customer. From a more tactical perspective, two points to note:

- Creative used for multinational brand launches generally avoid spoken-word monologue, to avoid the awkwardness of re-dubbing for new languages. A well-done animated character, if brand-appropriate, can demonstrate brand character without the challenges of cross-market casting.

- There’s no need to select a single “face” now. A chorus of well-chosen influencers can provide “brand voice” and brand visibility simultaneously. Key to influencer-led strategies is coordination. More on this in the next point.

2. Factice

Consider your points of sale and distribution. And don’t be narrow-mindedly digital. Shopify and Amazon make sales and distribution a possibility overnight. But the value of shelf-space in retail cannot be under-stated. (It’s even brought well-funded, highly-regarded startups to their knees with unexpected demand). Points to consider:

- Duty free shopping environments are among the best in the world for beauty brand sales. They are also a battlefield for shelf-space as well as ad-space. More on this below.

- If you’re selling online and in-store (congratulations!), measuring both channels can be complex. And consumer product sales measurement traditionally used by CPG brands don’t measure multinational sales in specialized environments well. Either way, it may be necessary to innovate in establishing KPIs to measure successful outcomes, particularly in the short-term launch timeframe.

3. Frequency

Finally, all launch campaigns – beauty or otherwise – are limited by budget. Inherently. To master your efficiency out of the gate, you need to be creative in achieving frequency. Key points:

- Timing. Is. Everything. Launch media – both paid, owned, and earned, must be intricately orchestrated and timed to push to maximize buzz. Budgets for a beauty brand launch campaign – particularly one with global ambitions – will never be large enough to sacrifice smart planning.

- In the case shared here, launch was “phased” market-by-market, focusing on high-visibility events to create maximum frequency for a jetset traveler audience who, in the client’s estimation, was a prototypical fashion editor jumping from fashion week to fashion week…

- Media planning and buying targeting traveler markets must be multi-pronged, visible and innovative, but success is truly dependent on strategic merchandising at point of sale, particularly for products as trial-based and experiential as fragrance.

The Beauty Brand Launch Solution, For Fragrance

Consumer care brands, and fragrance in particular, need frequency. Yet captivating an audience of transient, jetset global travellers in heavily-saturated Duty-Free retail environments isn’t easy. Thinking beyond “fragrance formula” marketing opportunities heavy on print and TV, we turned to experiential marketing and traveler media such as taxi TV to encapsulate our audience using robust animated video assets.

In all, our high-impact consumer marketing tactics “encapsulated” the international traveller in airport, inflight, and key live activations. Just weeks into the launch, the scent’s Parisian-inspired animated figurine would be ubiquitous to its target market of jetset international travelers seeking a signature scent. And word travelled quickly.

Case Results

Just three months after the fragrance’s international launch, sales topped one million units sold. By end of launch year, the fragrance ranked No. 2 in women’s fragrance sales in the brand’s home market.

In addition, the fragrance’s launch campaign creative received honours including Best Global Advertising (Grand Prix Stratégies), a Marie-Clare Audacity Award, Best Advertising Film (Fifi Awards UK), etc. And, in the ultimate proof of the brand’s commercial success, this single scent launched a range of 10 (and counting!) fragrance “flankers” – one of which won a FiFi award for Best Feminine Fragrance, along with a colour cosmetics range, and collaborations with a French sportswear apparel brand and American leather apparel maker.

Readings / Resources: