Trade Marketing Directors are on the front lines of global growth. They bridge the gap between operations and actual delivery of product in-market. They are diplomats for internal and external stakeholders. And they make things happen. And with such large responsibilities comes risk. How can a trade marketing director be sure they’re advising their company wisely? The answer lies in gathering counsel in the process of new market entry and avoiding simple (but deceitfully tempting) mistakes commonly made. In this article, we share trade marketing case study examples of brands – in some cases very publicly – making the Top 5 global market entry mistakes. Most cases use DTC scenarios, however all are pertinent to trade marketing at a global level.

And before we begin our countdown, let’s define terms:

-

“Trade Marketing” is the art and science of marketing to grow demand at the “total market” level. This includes wholesalers, retailers, distributors, and, of course, consumers. “Trade Marketing” is elevating a brand at the highest level. We see Trade Marketing Directors as pioneers in bringing products to market, and helping the total business succeed.

-

Entering a new market doesn’t necessarily mean a German brand launching in India, for example. It might mean expanding your audience to include a new customer set. It might mean adapting a B2C product for an enterprise B2B customer. Wherever geographic or strategic repositioning is needed, we believe this guidance might be handy.

Remember: marketing is generally tasked with market research to identify where a firm should grow, and developing new customer acquisition strategy. As a firm that’s brought dozens of brands to new markets successfully, Criterion Global acts as a CMO’s “BFF” pointing the way as decisions are made. Here is a countdown of the top 5 crucial – yet common – mistakes made by brands expanding to new markets:

- Lack of Internal “Listening”

- Skimpy External Analysis

- “Short-termist” Strategy

- Product-Market Fit Fail

- Templatization (aka Laziness)

#5 Lack of Internal “Listening”

Global trade marketing planning requires in-depth and specialized market research. In the vast universe of data, the most critical data points are those that reveal:

- The estimated opportunity available in a market (quantify),

- Ease of doing business in that market (quality of the opportunity), and

- Past successes / failure in that market (to further qualify potential).

Many businesses depend mainly on external data sources to help them make decisions. (We’ll discuss this next). Yet internal data is far more powerful to assess future potential. Are you experiencing an increase in leads from a specific market while not spending substantially on it? Do you think certain nations have a quicker sales cycle or a better win rate? Is the average buying price in a specific market higher? Third-party data providers do not know your consumer or brand. Only you can answer these questions. As bonus, it compels trade marketing directors to self-reflect on any failures that might caution against a specific approach or strategy.

“Knowing thyself is the beginning of all wisdom.”

-Aristotle

Trade Marketing Case Study on Internal “Listening” (Netflix):

Few brands are willing to publicly recount a time they misread internal data. Or willing to admit to trade marketing missteps. In hindsight, fortunately, Netflix is enough of a global success to shed some hubris and share some failures.

In 2011, Netflix was in its awkward “adolescence” between its DVD-by-mail business and streaming. They offered customers an $8/mo streaming plan, and/or an $8/mo mailed DVD plan. But previously customers got *both* for $10. This forced a re-evaluation of the service. Netflix lost 800,000 subscribers. Its stock dropped -30%. It’s become a business school case study in lost good will.

- What they botched: Most customers tended to use one option or the other, so a segmented approach might have been ideal. Or an $6/mo offer (in addition to the $10) to “upgrade” to a richer streaming service. In any case, Netflix botched the announcement by focusing on price rather than value [more].

- What they also botched: But, what often goes unsaid is that, in the 8 quarters prior to this admittedly-botched announcement, Netlix decelerated its ad spending. Customers were presented with the price hike at a time when Netflix was less top of mind. We’ll revisit this in a bit.

- How they re-calibrated: Netflix was unable to raise prices until 2017 (more precisely, subsequent price increases grandfathered existing customers). 6 years is an eternity in the high-growth tech space. But this time, in 2017, Netflix focused on customer value. It used its rich internal data to decipher which shows users cared most about. And it boasted this content with aggressive ad campaigns in the US + international markets. Stranger Things and The Crown were impossible-to-ignore in Netflix’s global media buying. The price increase coincided with to 2MM new US subscribers and 6.4MM abroad, leading to a huge stock increase.

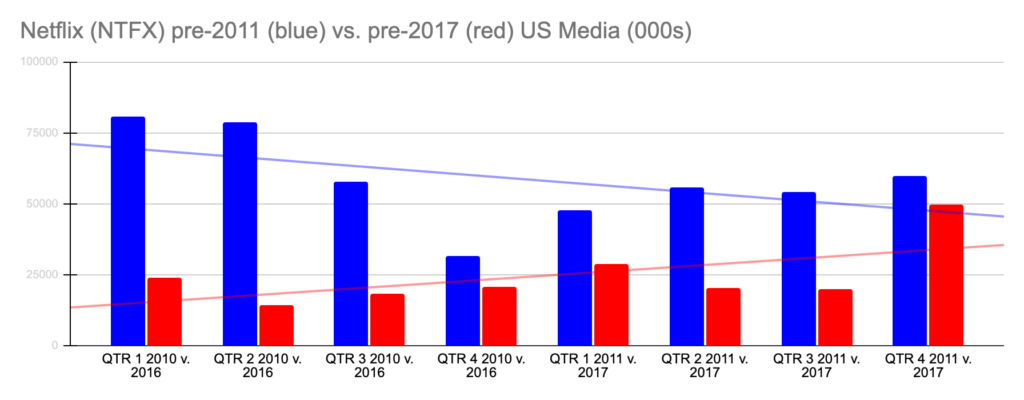

As the data show, Netflix’s 2017 announcement coincided with a crescendo in media investment (data are US-only, and while measurement changes create the appearance of lower 2017 investment, what’s clear is that investment increased in the lead-up to their October 2017 announcement):

Takeaway: In addition to a case on poor customer communication, Netflix simply did not use its internal data to remind customers of its value. In 2017, they paired the rate increase with a tour-de-force of media in-market, focused on retention and new customer acquisition, reminding customers of why they love Netflix.

#4 Skimpy External “Listening”

As mentioned, trade marketing is a tricky proposition. Trade marketing directors have a multitude of considerations in going to market. External research is a critical step for market sizing, budget analysis, and “seeing around corners” in what obstacles may come. Our media consulting practice supports trade marketing leadership on marketing considerations, which covers competitive considerations, but the input of legal counsel should also be an important voice in the process. Our next case shows why:

Trade Marketing Case Study on External “Listening”: (Peleton)

Peleton, iFit, and Lululemon are in the business of streaming technology through workout equipment they sell. Each of these companies are headquartered and operated in North America, which hardware largely imported from China. The three brands are among many in the “connected fitness” space that run streaming services through hardware they claim as proprietary.

However, DISH Network holds a US patent on streaming technology through workout equipment. It appealed to a US International Trade Commission court through a lawsuit alleging infringement by the companies from August 2016 to March 2021.

- Where they went wrong: Hindsight is 20/20, and the wide-reaching language of the DISH network patent (surely secured in an earlier pre-streaming era) may have caught iFit, Peleton and Lululemon/Mirror unaware. But a patent search might have caused these brands to proactively approach DISH. A potential streaming deal may have enabled DISH to offer Peleton, iFit, and Mirror content for in-home streaming via TV, with persistent messaging for offers for viewers to purchase the branded devices. An ounce of prevention is worth a pound of cute.

- The Outcome: The U.S. International Trade Commission judge sided with DISH Network.

“Customers of these products could just as easily exercise in front of their existing television — in particular, a television that is lawfully using the technology of the Asserted Patents,”

DISH Network, discussing the ITC judgement.

In addition, Peloton and iFit previously sued one another for patent infringements: iFit asked the U.S. International Trade Commission block Peloton’s device imports. Peleton and iFit have since settled ongoing litigation, with iFit scrapping leaderboard features, and Peloton agreeing to license iFit patents on remote control technology. Peleton meanwhile still has ongoing legal issues concerning the licensing of music featured in the service.

The Takeaway: Proceed with caution when considering external research, such as that concerning patents, licensing rights, or other matters that can result in legal costs and headaches. This is true particularly for international trade marketing (when entering new markets), as courts are likely to favor the domestic or local party over a new/foreign player.

#3 “Short-termist” Trade Marketing Strategy

Executives often think about foreign markets in broad geographical terms (e.g., “We’re transferring our attention to Asia,” or “We’d want to quadruple our growth in Europe”). But oversimplification is problematic. When you ask people what they mean by “Europe,” you’ll receive various answers: Western Europe, the European Union, the eurozone, and so on. Customers identify at the national level, and marketers must remember that each country has its local laws, cultural norms, currency and payment systems, and business practices.

It is critical to divide larger regional “markets” into particular nations with unique revenue and lead-generating objectives and to conduct proper local market research. Being more detailed from the start helps prioritize markets. This, in turn helps in defining hiring and talent strategy. Finally, only after defining SMART goals (Specific, Measurable, Achievable, Relevant, and Time-Bound), can budget allocation follow. all of which are required to assist a firm in achieving its targeted worldwide objectives. Local market research must understand the market size, the difficulties consumers experience, their existing solutions, and where your product may fit in. Many businesses fail to consider the fundamentals of product positioning at the national level, overlooking factors such as intense local competition.

Short-Termism: Trade Marketing Case Study (Atlético Madrid x Columbia Pictures)

This one is controversial. In the 2003-2004 La Liga Season, Columbia Pictures penned a jersey sponsorship deal with Atletico Madrid to place film titles – 16 in all – on player uniforms. As a trade marketing case, this was likely not the best approach given the coveted (read: expensive) nature of the deal, and diminished effectiveness of 16 separate rotating jerseys during the season. Granted, ad effectiveness measurement for entertainment marketing in 2003-4 wasn’t what it is today.

- What they got right: If Columbia Pictures was aiming to drive domestic Spanish box office visits, Atletico Madrid – the less expensive, more domestically-followed team representing Spain’s #1 box office market – was a good choice. Additionally, the innovative sponsorship format set a record for greatest number of sponsors featured in a season that still stands today.

- What they didn’t: But sponsorship fell short in effectiveness, however, as it lacked precision. Arguably, Columbia was operating without a tangible outcome in mind beyond broad exposure. Seasonal sponsorships for football “kits” work nicely in offering consistent logo placement during the course of a season, maximizing total reach. But the rotation of titles made for harder-to-read designs with less overall, aggregate impact. And having the Spanish translation of “White Chicks” on the jersey of pro footballers (to promote the 2004 Waynan Brothers comedy) is a matter of mixed opinion.

The takeaway: Columbia was trying to promote its lineup of box office releases. But in persistent rotation of the jersey designs, it minimized the value of the placement: consistency of a specific brand image. Columbia was seeking short-term benefit from a tactic better suited to long-term outcomes. But there is one unforeseen upside of the deal: since the film titles were rotating frequently, these are some of the most hard-to-find collectible jerseys. Why? The rotation of 16 jerseys was dizzying, and years later Nike opted not to re-issue replica re-editions of the shirts, so the only ones in existence were player-worn [watch more]. (photo credit: Classic Shirts).

#2 Trade Marketing “Product-Market Fit” Fail

Product-market fit is a bit of nonsense business jargon. The term is used for any number of *actual* reasons for business failure. It’s also often a disguise for lack of marketing or poor marketing. How else can the market learn about a product except by marketing it? Thus it’s not a matter of “fit” but educating your potential audience.

Nevertheless, too frequently, companies attempt to offer similar items in various markets. They may be oblivious to the reality that “markets” (customers, audiences, prospects) likely differ from market-to-market. For example, a software business may flop in a new market if its audience doesn’t understand its full capabilities. Depending on audience education, they may be advised to offer a simpler product to familiarize users with it. Then introduce feature-by-feature over time. Alternatively, a more sophisticated market may need more functionality than offered.

Pricing is another concern (see the Netflix Case Study above). Pricing will vary since the value offer differs from market to market. While it is not always necessary for businesses to adapt their pricing structure for foreign markets, many companies discover that making changes at the local level allows them to develop much faster. In addition, payment methods differ significantly from one nation to the next. Pricing tactics for markets that are primarily cash-based vs. credit-card-oriented, for example, must be considered by marketers.

Product/Market Fit Case Study: Friendster

Have you heard of Friendster? Odds are no.

Friendster began in 2001 as a social gaming site. It was widely popular in Asia, with 115 million registered users in 2011. Through the platform, users could play online games and “send messages, write comments, post media and share content with other users publicly or privately. It was also used for dating, discovering new events and joining new hobbyist circles.” (read more).

What happened? Friendster was growing and seemed for a time to be a potential rival of Facebook (which didn’t start until 2003/4). Press about its decline, and reasons why it declined just as Facebook was taking off is inconsistent and poor. Which reveals much about why “product-market fit” is an often sloppy catch-all term for business foibles.

The root issue. As we see it, Friendster’s #1 issue was the product, followed by the marketing. As its founder Jonathan Abrams tells Mashable, Friendster’s investors didn’t care that the site had serious service issues in 2003. Abrams wanted to create “Friendster university” which would have pre-empted the near-exponential virality seen in Facebook adoption on-campus in late 2003-4.

“…[M]ore fundamentally, people could barely log into the website for two years,” he says. “By the time Facebook and MySpace was doing those things, Friendster had lost a lot of market share in the U.S. for stability issues.”

Jonathan Abrams, Founder of Friendster, as told to Mashable.

The Takeaway: Here Friendster had product issues which created a marketing issue (in the sense that Friendster wasn’t able to market, as its site kept crashing). While this is summed-up as “product-market fit” issue (see Failery, Esquire, or listen to the 2-part miniseries about Friendster on Gimlet’s show “Startup“), this isn’t the same thing. Our summary here is: you can’t have effective advertising without an effective product (and an efficient means of delivering it to the customer). Given the rampant challenges they face, “product-market fit” umbrella mistakes are #2 most common issues we see for trade marketers entering a market.

#1 Trade Marketing Mistake: Templatization

Many brands depend on the logic that what’s worked in the past will hold true for the future. And while history is an invaluable guide, it’s not always the best guide for entering new markets.

Often brands repurpose the same strategy that earned them local success when entering new markets. While brand consistency is essential in advertising, many markets prefer unique distribution strategies. For example, selling goods and services via local partners, (i.e. resellers or channel partners), may be best versus direct sales strategies in countries where relationships have a greater cultural significance, such as Japan. In contrast, SaaS, internet, and “touchless” sales approaches are ideal in markets where automation is valued, such as DACH, Nordic, or North American markets.

Trade marketing must flex to its market. And strategies must often be personalized even within markets in the same political territory. For example, rural markets might be best reached via Meta products, but audiences in major urban markets have busy people consuming an entirely different set of media. Local, market-specialist media planning and buying is a must.

Templatization is the enemy in trade marketing. So often brands (particularly in tech) wish to smooth the complexity of new market entry by relying on a universal “ad stack” of digital media performance platforms. (Think: Meta and Facebook/Instagram, Google + YouTube, Shopping Ads, Native Content Ads, and perhaps Snap or TikTok).

But time and again case studies show a diversified, localized approach to media helps fight CPA-creep on performance media channels. In short: Brands that avoid “templatized” thinking have a competitive edge.

Templatization: 3 Trade Marketing Case Study Lessons:

As we’ve said before, it’s near-impossible to investigate campaign fails because few brands are willing to admit defeats. For this final “Mistake” made by Trade Marketers, we’re summarizing 3 cases – two of which are our own – to show how woefully common templatization is, and specific steps taken to prevent it.

- Global B2B Marketing for Copart: This trade marketing case gives a B2B look at how the world’s #1 auto ecommerce auction platform went global. In it, we specifically show how the brand’s creative initially relied on templatization, in the form of creative that didn’t account for the geographic distance between markets. Read to learn more.

- How Coke + Pepsi Entered India: Coke and Pepsi Co (available at HBS): This HBS case traces the growth of the beverage industry in India and shows “the emergence of two global majors – Coca Cola Company and PepsiCo” in-market. “While Coke, Diet Coke, Sprite, and Fanta belong to Coca Cola Company; Pepsi, Diet Pepsi, Mountain Dew, 7 Up, and Mirinda belong to PepsiCo. ” However, these “majors” encountered various local Indian brands – Thums Up and Limca – that challenged their position. “The case describes the role of advertising in building brand equity..[and] traces the evolution of advertising over the years globally as well as in India.”

- GoDaddy, Going Global: And on this same note, we’ll conclude with our video case on how Godaddy approached market evaluation and market entry for the UK as well as India. The strategy avoids templatized thinking, in that our media consulting practice considered the full range of competition as well as guidance for building brand equity over the long term.

Conclusion: Get the best counsel and listen to it.

One of the most disheartening missteps – for trade marketing directors or anyone leading a business effort – is having access to competent, bright minds, but failing to use their input when making strategic choices.

The same tools do not work in every market. Past successes may not always succeed. And failings are often more illuminating than even the easy-wins for the teaching they provide. The most challenging barrier that businesses confront isn’t gathering data or even developing a product (though it’s vital: see Friendster case above). It’s finding excellent counsel and listening. Make the most of your current advisory team and give their input weight. They are by far your most trustworthy counsel.

For more guidance on navigating trade marketing and global media buying, contact Criterion Global here.

*Contents of this article and information on this site is for general information purposes only to permit you to learn more about our firm and services. These contents are not legal advice, nor does this article offer any promise, guarantee or warrantee against the prospect of legal action, form an attorney-client relationship, is not to be acted on as legal counsel, may not be current and is subject to change without notice. Past outcomes of case studies shared does not guarantee future results.